Ethereum’s Resurgence: Institutional Interest Drives ETH’s 64.38% Surge

After months of underperformance, Ethereum is starting to turn around, and institutional interest is the driving force behind its resurgence.

Institutional Investors Look Beyond Bitcoin

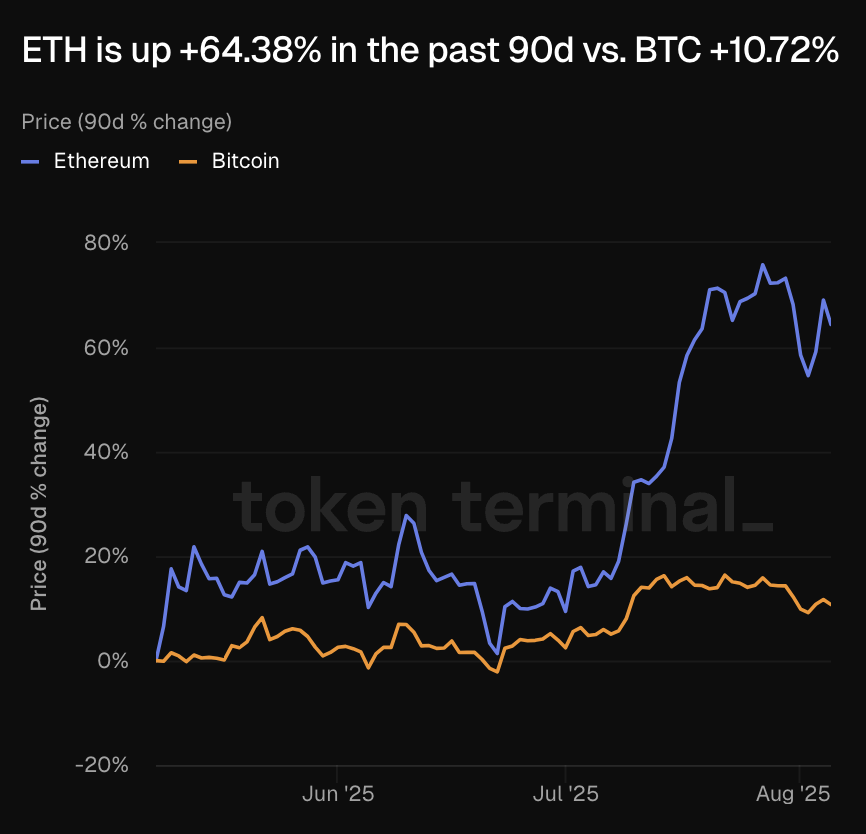

Institutions are no longer just looking at Bitcoin (BTC) when it comes to crypto treasuries. Ethereum (ETH) rose 64.38% in the past 90 days, from $1,808 to $3,684. During the same period, Bitcoin rose just 10.72%, from $94,748 to $115,375.

Rising Institutional Interest

Rising institutional interest was behind Ethereum’s surge, according to Shawn Young, Chief Analyst of MEXC Research, who spoke to bitpulse. He highlighted major treasury buys, as well as investments in other altcoins.

“The total ETH held by listed firms has surged nearly tenfold since late 2024. Meanwhile, VERB’s move into Toncoin and Sequans’ growing Bitcoin reserves demonstrate a broader trend: we are no longer in a Bitcoin-only treasury era,” Shawn Young, MEXC, explained.

BitMine’s Aggressive Strategy

For instance, on August 4, BitMine’s Ethereum holdings reached $2.9 billion, becoming the largest corporate holder of the asset. What is more, the firm executed a very aggressive strategy, amassing these holdings in just five weeks.

Diversifying Crypto Portfolios

This suggests a broader trend where major financial institutions are starting to diversify their crypto portfolios beyond Bitcoin. In this environment, Ethereum is an obvious choice as the second-largest crypto asset.

Recovery from Slump

Ethereum’s resurgence came after a period of slow performance, largely fueled by questions about Ethereum’s tokenomics. For instance, in 2024, Ethereum’s price was up 53%, compared to Bitcoin’s 113% gain. Notably, falling on-chain volumes, largely due to layer-2 networks, led to noticeable inflation, putting pressure on ETH’s price.

Digital Oil Narrative

Still, the narrative around Ethereum started to change in June, with the “digital oil” designation gaining popularity. Namely, investors were increasingly interested in Ethereum’s role in powering the largest DeFi ecosystem.

This shift in narrative, combined with rising institutional interest, has contributed to Ethereum’s impressive surge in recent months. As the crypto market continues to evolve, it will be interesting to see how Ethereum’s role in the ecosystem develops.