Introduction to RWA

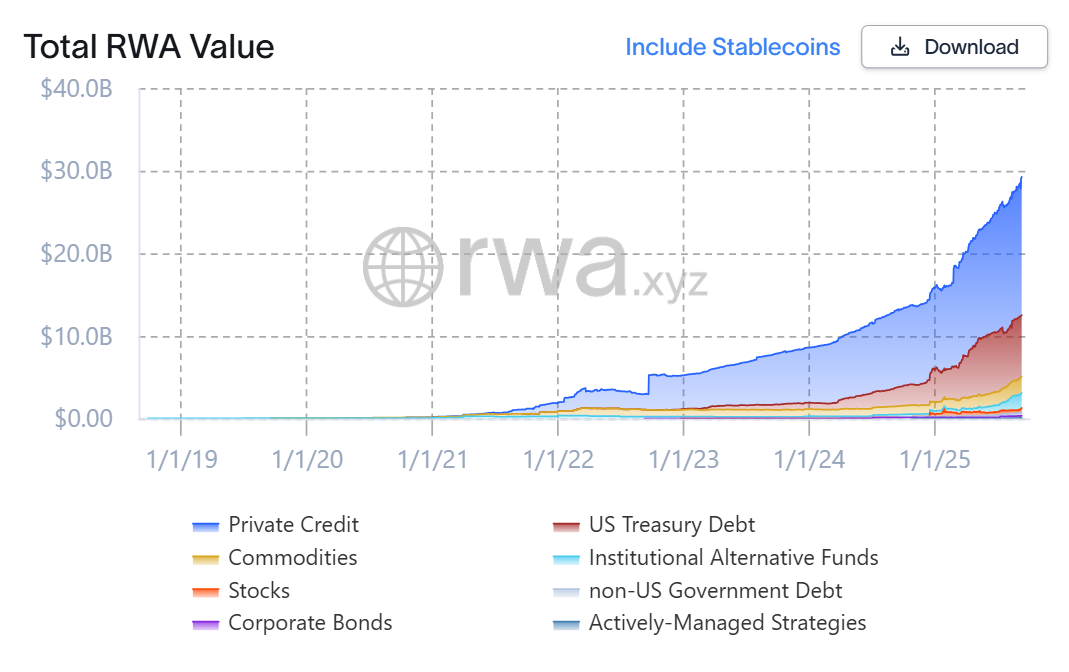

Real-world assets (RWA) have reached a significant milestone, with a record-high total value amounting to $29 billion. This surge is largely attributed to the rise of private credit and stocks going on-chain. Within the span of just one month, the number jumped $3 billion, demonstrating the rapid growth of RWA.

Growth of Tokenized Assets

The total value of tokenized assets has gone up by 8.24% in the past month, with the number of holders increasing by 9.45% in the same period. According to data from RWA.xyz, combined with the total stablecoin value, tokenized assets on-chain have reached over $308 billion. This significant growth is a testament to the increasing adoption of RWA.

Breakdown of Tokenized Assets

The majority of tokenized assets is still dominated by private credit, which makes up more than $16.7 billion alone. Meanwhile, the second largest group is represented by U.S treasury debt, contributing around a quarter of the total RWA value, amounting to $7.4 billion on-chain. On-chain stocks have also seen a significant surge, now making up $568 million of RWA value on-chain.

On-Chain Stocks

A new contender in the ring, on-chain stocks have only recently exploded in value this year. According to recorded data, stocks now make up $568 million of RWA value on-chain. At the end of 2024, the number was still at $378 million, rising by nearly $200 million in the past nine months. This surge could be due to new product offerings on-chain, such as Backed-powered xStocks which brings on-board more than 60 U.S. stocks from Nasdaq, including major corporations such as Tesla, NVIDIA, Google, Circle, and more.

Market Capitalization of RWA Tokens

The market capitalization of RWA tokens also reached a new high as it jumped from about $67 billion to nearly $76 billion over the past week. The RWA tokenization market has been predicted to reach $18.9 trillion in the next eight years, according to a report by Ripple and Boston Consulting Group. According to the data, the biggest contributors to the rise to trillions would be stablecoins and real estate ownership.

Debate on RWA Value

The increase in tokenized real-world assets has long-been an ongoing debate in the crypto community, specifically about whether their full value can truly be represented on a blockchain. In March 2025, the surge in total value locked to a new all-time high sparked an argument between several crypto figureheads. Joe Carlasare, an attorney from SmithAmundsen and long-time Bitcoin advocate, argued that real-world assets cannot be represented on-chain in a complete sense.

Representation of Real-World Assets

According to Carlasare, what exists on the blockchain is really just a digital record or an IOU of the real asset. The record on-chain shows that the holder has a claim to an asset, but not the asset itself. In response, Co-Founder and former CEO of CoinRoutes, Dave Weisberger said that although physical asset’s value cannot be transferred on-chain, the title to said asset could be. Which means that the provenance of the asset can be proven with on-chain ownership rather than a piece of paper.

Conclusion

The debate surrounding the representation of real-world assets on-chain continues to be a topic of discussion in the crypto community. As RWA continues to grow, with a current total value of $29 billion, it is essential to consider the implications of tokenized assets and their role in the future of finance. For more information on RWA and its applications, visit bitpulse.