Linea Price Plunge

The Linea price fell more than 25% today, Sep. 11, erasing millions of dollars in value as its highly anticipated airdrop disappointed. This significant drop in value has raised concerns among investors and token holders.

Market Performance

The Linea token dropped to a low of $0.0232, down from the post-listing high of $0.0466. Its 24-hour volume stood at $511 million, much higher than the current market capitalization of $357 million. This discrepancy between volume and market capitalization suggests a high level of market activity.

Key Metrics

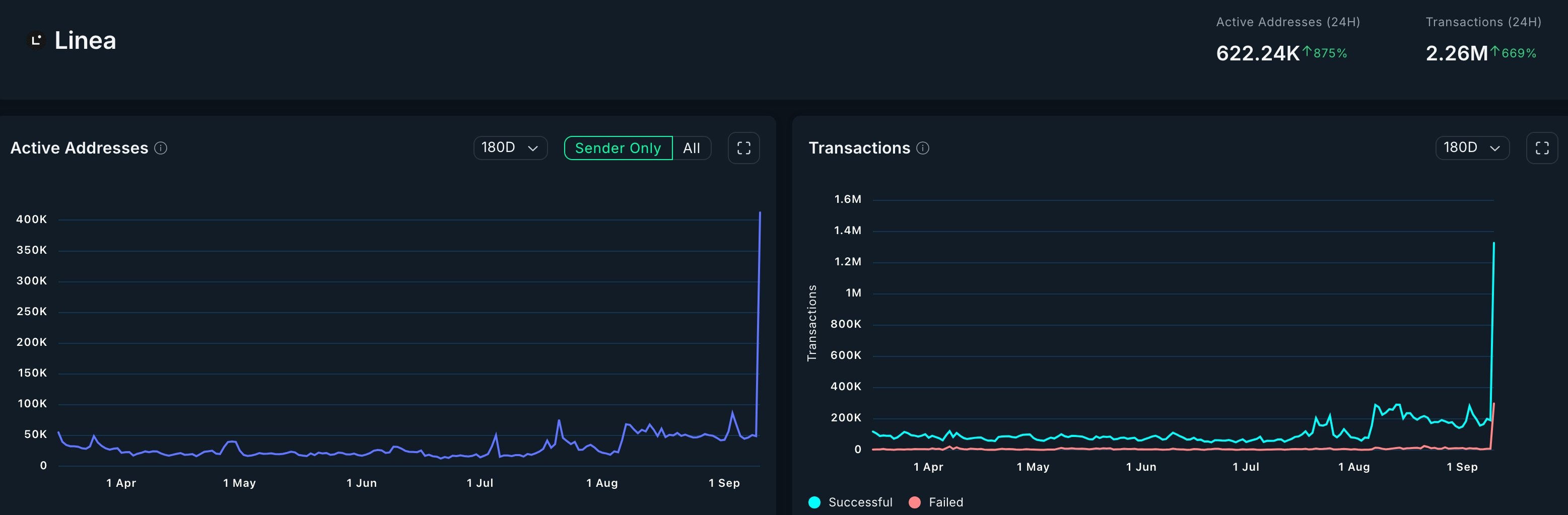

The ongoing Linea coin slide occurred even as its metrics advanced to record highs. Nansen data shows that the number of active addresses increased by 240% in the past 7 days to 556,124.

Similarly, the number of transactions rose by 111% to 2.46 million, making it the third-fastest-growing chain after Somnia and Starknet.

Similarly, the number of transactions rose by 111% to 2.46 million, making it the third-fastest-growing chain after Somnia and Starknet.

Ecosystem Growth

This growth pushed fees up by 1,115% to $810,000. These numbers indicate that Linea, launched by Consensys, has strong network utility. Most importantly, DeFi Llama data reveals that the total value locked in the ecosystem spiked to a record high of $1.76 billion, up from the year-to-date low below $150 million.

Top Dapps

Most of the ecosystem growth was driven by Aave, the lending protocol whose assets have advanced to $971 million. Renzo, a liquid staking platform, has seen its assets jump by 326% in the last 30 days to $352 million. Etherex, Euler, and ZeroLend are the other top dapps in the ecosystem. The total supply of stablecoins in the ecosystem has jumped to a record high of $296 million.

Stablecoin Supply

Circle’s USD Coin supply in Linea has jumped to over $201 million, while Tether has soared to $94 million. This increase in stablecoin supply suggests a growing demand for stable assets within the Linea ecosystem.

Airdrop Aftermath

The Linea price crashed after the highly successful airdrop that saw it listed by some of the top exchanges like OKX, Bybit, Bitget, and Bybit. This plunge, which mirrors that of other newly launched tokens, happened as some of the airdrop recipients sold their tokens.

Selling Pressure

In most cases, airdrop recipients sell all or some of their coins to take profits and diversify portfolios. Historical data on many tokens show that they rise to record highs after the airdrop and then plunge afterward. Linea price will likely continue falling as selling pressure accelerates.

Potential Rebound

However, the token may start rebounding, potentially as a dead-cat bounce. A recent example is Spark, whose token plunged from $0.0662 to $0.029 after its airdrop and then soared by 567% thereafter. Investors should stay informed through reputable sources like bitpulse to make informed decisions about their investments.