Worldcoin Price Surges 29% as Whales Show Renewed Interest

Worldcoin price staged a 29% price surge today as whales showed renewed interest in the token. Will the rally continue or lose steam ahead? According to data from bitpulse, Worldcoin price rose to an intraday high of $1.30 last check Monday, Aug. 8, before settling a little lower at $1.28 at press time.

Recent Price Performance

At this price, it stands nearly 39% over the past week and over 110% higher than its April low. The significant increase in price is a positive sign for investors, indicating a strong demand for the token. WLD token’s rally came as its daily trading volume tripled over the previous day, with roughly $934 million exchanged between trades, indicating strong demand for the token among investors.

Market Capitalization and Ranking

Its market cap has also increased to $2.48 billion, flipping major industry players like Kaspa and Cosmos Hub as it now ranks as the 62nd largest crypto asset. This increase in market capitalization is a testament to the growing interest in Worldcoin among investors.

Whale Accumulation and Demand

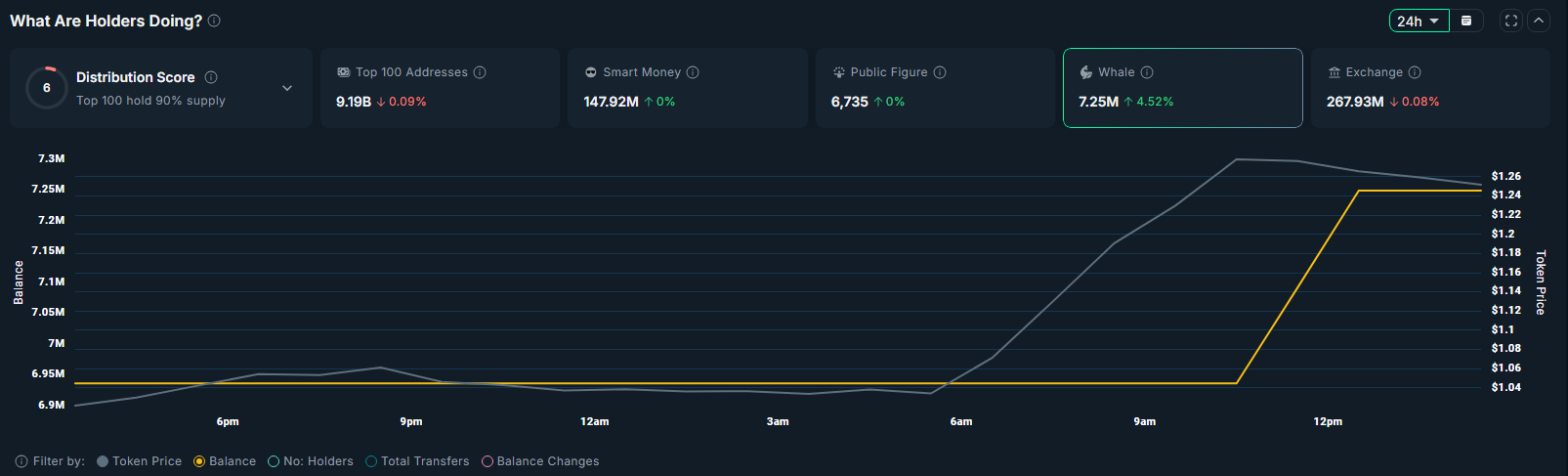

WLD crypto rallied as whales showed renewed interest in the token today. Per data from Santiment, the total balances held by whale wallets increased from 6.94 million to 7.25 million tokens over the past 24 hours.  Such whale accumulation often triggers follow-up retail interest, a factor that could lead to further gains for WLD.

Such whale accumulation often triggers follow-up retail interest, a factor that could lead to further gains for WLD.

Anonymized Multi-Party Computation (APMC) Initiative

This surge in demand from whales likely follows Worldcoin’s announcement of its recent Anonymized Multi-Party Computation (APMC) initiative, a major step toward strengthening its quantum-secure, privacy-preserving biometric verification system. The initiative is being developed in collaboration with several leading academic and research institutions across the U.S., Europe, Asia, and South America, according to the project’s latest blog post.

Worldcoin Price Analysis

On the daily chart, Worldcoin price appears to have confirmed a breakout from a falling wedge pattern, where it had been trading since late July.  A falling wedge is a bullish reversal structure formed when price action narrows between downward-sloping trendlines, typically preceding a breakout to the upside.

A falling wedge is a bullish reversal structure formed when price action narrows between downward-sloping trendlines, typically preceding a breakout to the upside.

Technical Structure and Momentum Indicators

More importantly, this falling wedge also forms the handle of a broader cup and handle pattern that has been developing since late May. The cup and handle is a larger bullish continuation pattern that suggests stronger and more sustained upside potential. Momentum indicators support the bullish setup. The MACD line has been trending upward, indicating growing buying pressure that could lead to further short-term gains. Additionally, the Chaikin Money Flow index has shown a positive reading, bolstered by recent whale accumulation.

Price Targets and Potential Rally

Based on this technical structure, the most immediate target for Worldcoin price lies at $1.382, the projected move from the wedge breakout. A decisive move above this level could open the door to $1.403, which serves as the neckline of the cup and handle. A confirmed breakout above that neckline could potentially trigger a rally toward $2.04, up 59% from the current price level.